Ways to Donate

Why donate to CFNC?

- It leaves a lasting impact. Your donation won’t be limited in the same ways a direct gift to charity could be.

- You can leave any asset type. Cash, stocks, bonds, real estate, life insurance and more are welcome.

- You choose the cause. Our team will ensure your donation directly supports your goals and values in Noble County.

- We handle the details. You experience the satisfaction of giving, while we take care of the stewardship of your gift.

- We care about Noble County. Your gift will stay right here to invest in your community.

A variety of ways to create a lasting impact

Your Giving Options

Ready to make a difference? Explore the many ways you can contribute to the Foundation of Noble County, each offering unique benefits to you and our community. We’ve made it simple to give, so you can focus on the impact you want to create. We accept the following:

- Stocks and Bonds

- Real Estate

- Retirement Assets

- Cash

- Insurance

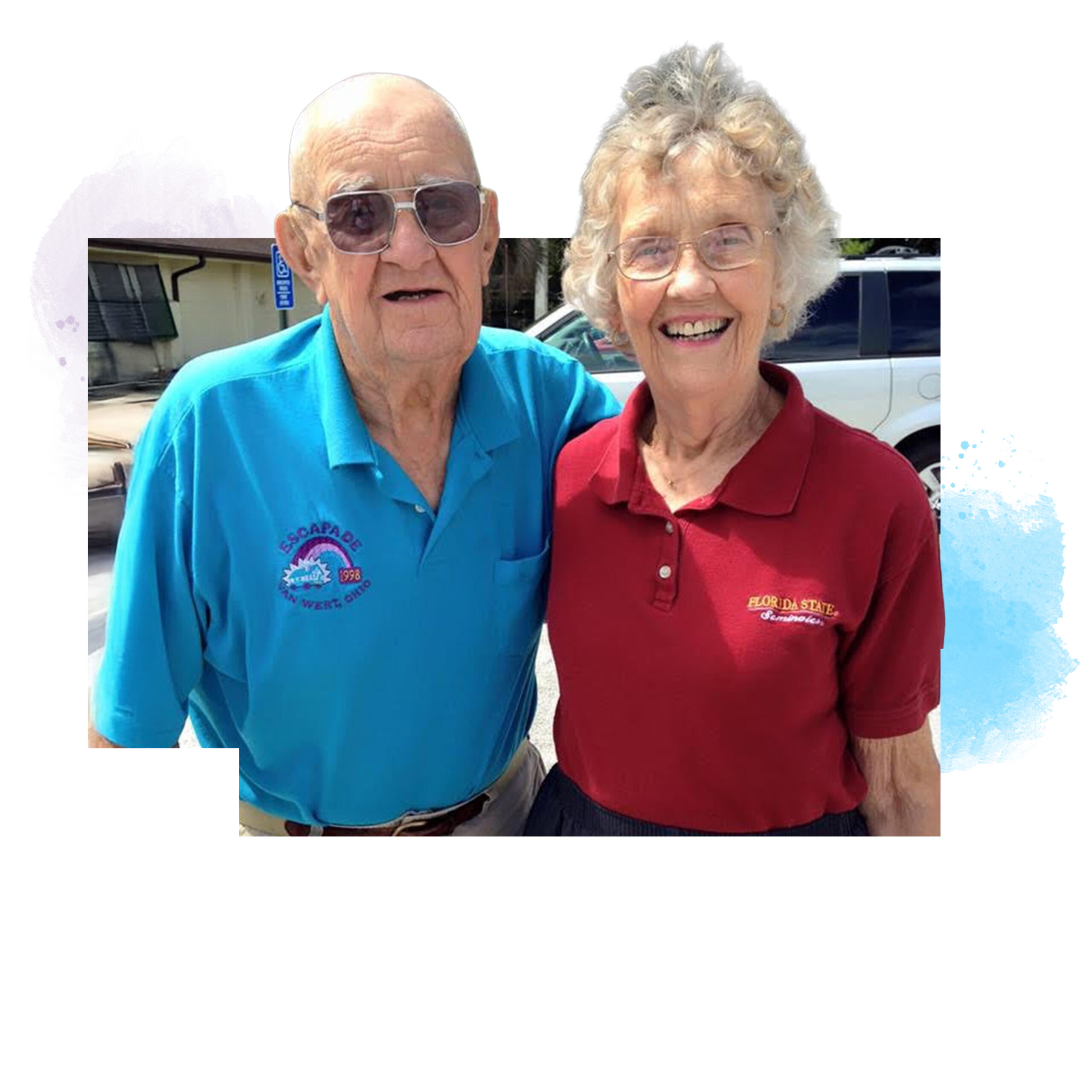

When we think about our legacy, it’s not about the money we’ve accumulated, but the community we’ve helped build. Supporting our local students and organizations through the Community Foundation is our way of giving back to the place that gave our family so much.

Creating your Noble Legacy

The Noble Legacy Society recognizes donors who have invested in the future of our community by naming the Community Foundation of Noble County as a beneficiary in their estate plans or by adding to one of our existing funds. Members are invited to all foundation events, including a special annual reception exclusively for Legacy Society members. Their names are also featured in our publications to publicly thank them and inspire others to join their ranks.

Want to learn more about how to make a planned gift? Reach out to one of our team members below.